This bonus does not exist on the personal version of the card.Īmerican Express Membership Rewards points are valuable because they are flexible. Points earned on transactions over $5,000 are worth an effective 3% back when redeemed in this manner. This gives an effective return rate of 2 cents per dollar, which is more than any other American Express card offers on unlimited spending in every category. The most interesting perk of the business version of the Centurion Card is a generous 50% rebate on airfares purchased with Membership Rewards points.

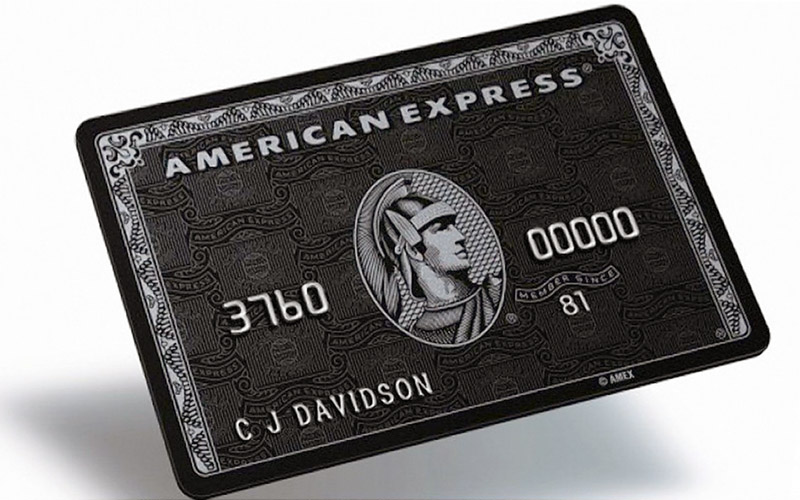

The Centurion® Card from American Express * offers 1 point per dollar on all other eligible purchases. If you are given a choice, the business card offers more valuable benefits-most notably, the airfare rebate. Something to keep in mind: The Centurion comes in both personal card and business card versions. That said, you can request consideration online if you want to give it a shot. Minimum spending estimates vary from $250,000 per year up into the millions. The criteria used to determine if you’re worthy to even apply are nebulous, but it’s safe to say if you’re not on a first name basis with your American Express rep, the Centurion Card is probably not in your wheelhouse. Events including celebrities of the entertainment, culinary and sports arenas are offered solely to cardholders. Access to a 24/7 concierge service is a big draw if you are interested in delegating your travel planning, reservation getting and gift giving tasks.

However, the credits and perks only have value if they are of use to you.Įxclusivity is the main draw of the Centurion Card, and it’s expressed in many ways. The upsides, which include bend-over-backwards customer service, elite travel statuses, memberships and credits to luxury outlets and lucrative points redemption options, can easily offset the costs. That said, for the biggest of big spenders, the Centurion Card can be worth every one of the million pennies that cover just the initiation fee. The Centurion Card has a lot of downsides: a large initiation fee, annual fees that rival a luxury car lease and a distinct lack of category spending bonuses.

#Centurion card benefits australia full#

Compare Standard and Premium Digital here.Īny changes made can be done at any time and will become effective at the end of the trial period, allowing you to retain full access for 4 weeks, even if you downgrade or cancel.The Washington Post used to have a slogan that’s apropos for the Centurion Card: If you don’t get it, you don’t get it. You may also opt to downgrade to Standard Digital, a robust journalistic offering that fulfils many user’s needs. If you’d like to retain your premium access and save 20%, you can opt to pay annually at the end of the trial. If you do nothing, you will be auto-enrolled in our premium digital monthly subscription plan and retain complete access for $69 per month.įor cost savings, you can change your plan at any time online in the “Settings & Account” section. For a full comparison of Standard and Premium Digital, click here.Ĭhange the plan you will roll onto at any time during your trial by visiting the “Settings & Account” section. Premium Digital includes access to our premier business column, Lex, as well as 15 curated newsletters covering key business themes with original, in-depth reporting. Standard Digital includes access to a wealth of global news, analysis and expert opinion.

During your trial you will have complete digital access to FT.com with everything in both of our Standard Digital and Premium Digital packages.

0 kommentar(er)

0 kommentar(er)